A Review of the Interest Rate Environment in 2023

Clients often ask about the effect the Federal Reserve has on interest rates. Often there is a misconception as to what rates they directly control vs. which rates the market dictates. While the Federal Reserve's short-term rate policy can influence all interest rates, it is not the sole determinant. The interplay of market forces, investor sentiment, and macroeconomic factors can result in divergent movements between short-term and long-term interest rates.

The Federal Reserve Bank does directly set the shortest-term lending rate through the Federal Funds Rate.

Banks receive this overnight lending rate on excess deposits, for example. Bonds that are shorter term, say 3 months, are heavily influenced by this rate. As the term of the bond increases, a broader range of market forces influences the rate.

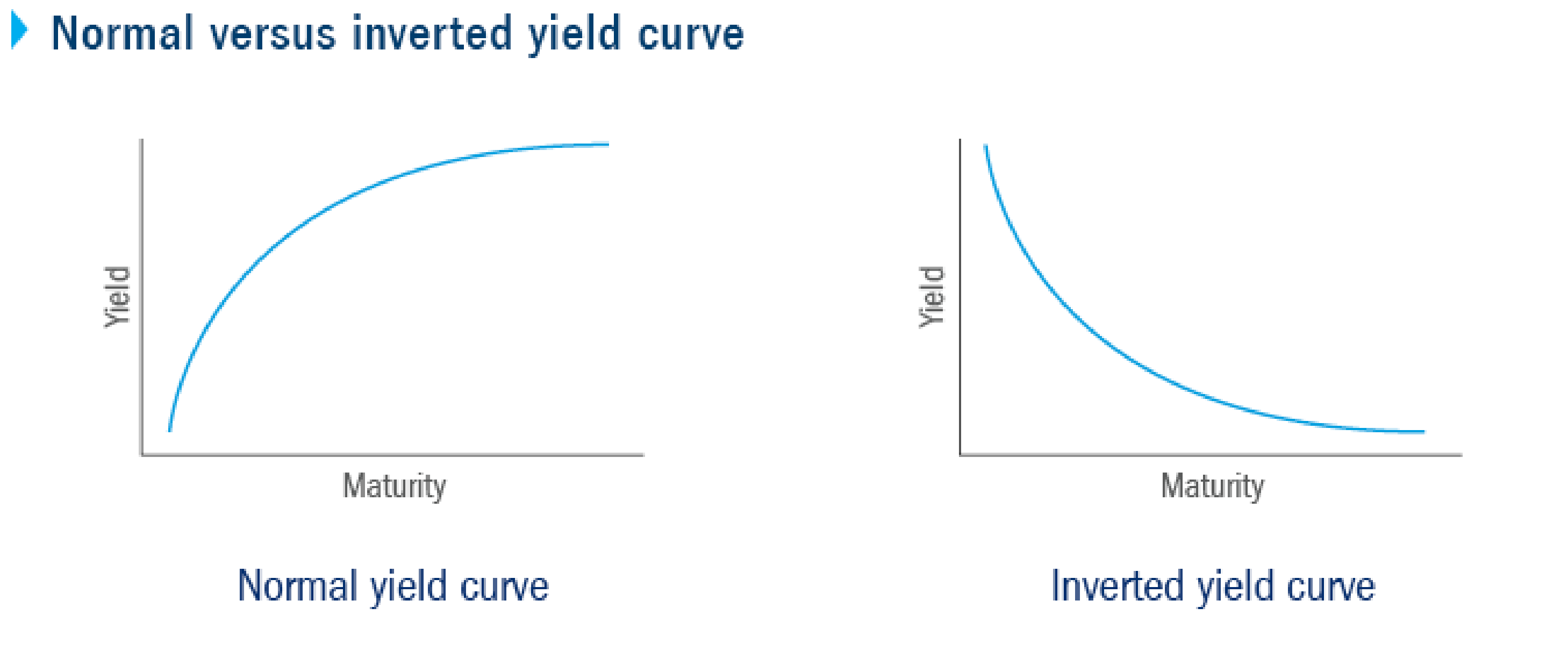

Typically, you are paid a higher annual interest rate for locking up your money longer when buying a bond that matures further out. If you were to chart out on a line graph Treasury bond interest rates ranging from 3 months to 30 years, you would have something that is referred to as the “yield curve.” When the yield curve is “normal” it is upward sloping where the short-term interest rate pays less than the longer-term bond. A quick look at the current Treasury market in mid-May showed a 6-month Treasury paying 5.1% while a 10-year Treasury bond is only paying around 3.5%. Currently, shorter-term bonds are paying a higher interest rate than longer-term bonds. The yield curve is said to be inverted when this happens which is also a possible warning sign of an upcoming recession. This situation illustrates a scenario where despite the Fed raising its rate, longer-term rates are still not as high as you may expect.

Long-term interest rates are influenced by market expectations of future economic conditions.

The market could have lower long-term interest rates if the market predicts rates to decline in the future.

This could be for a number of reasons such as an expectation that inflation will continue cooling or lower than expected long-term economic growth. Ultimately, it is somewhat of a prediction of where rates will head in the future.

Bonds are also impacted by supply and demand dynamics. If economic conditions deteriorate globally, the demand for guaranteed government-backed U.S. Treasury bonds would likely increase as there is commonly a flight to safety among investors. This increase in demand would mean that the U.S. could then offer to pay a lower rate on their Treasury bonds. Additionally, if the U.S. offers a higher rate on their government debt than, say Europe, then this will create a greater demand for U.S. treasuries. This could then decrease the interest rate that U.S. Treasuries have to pay should international investors increase their demand for this U.S. debt.

As you can see from this discussion, given all these factors, it is very difficult to predict where interest rates will go. Clients commonly ask whether they should wait to buy a bond until after the Fed raises rates.

Even if the Fed raised interest rates, longer-term rates could simultaneously fall based on some of the market dynamics discussed. Market timing for either the stock or bond market cannot be accomplished with any consistency. When comparing bond investments it is typically best to consider what yield and income the bond will pay and consider whether this corresponds with your goals.

A good financial advisor can help you build out an income plan so that your portfolio properly generates income that you can live off in retirement.

Respectfully Submitted

CRA Investment Committee

Matt Reynolds CPA, CFP® Tom Reynolds, CPA

Robert T. Martin, CFA, CFP® Gordon Shearer Jr., CFP®

Jeff Hilliard, CFP®, CRPC® Joe McCaffrey, CFP®

Phillip Tompkins

(This article is for informational and educational purposes only and should not be relied upon as the basis for an investment decision. Consult your financial adviser, as well as your tax and/or legal advisers, regarding your personal circumstances before making investment decisions.)